INFORMATION TO THE MARKET

SÃO PAULO, MAY 22ST 2018

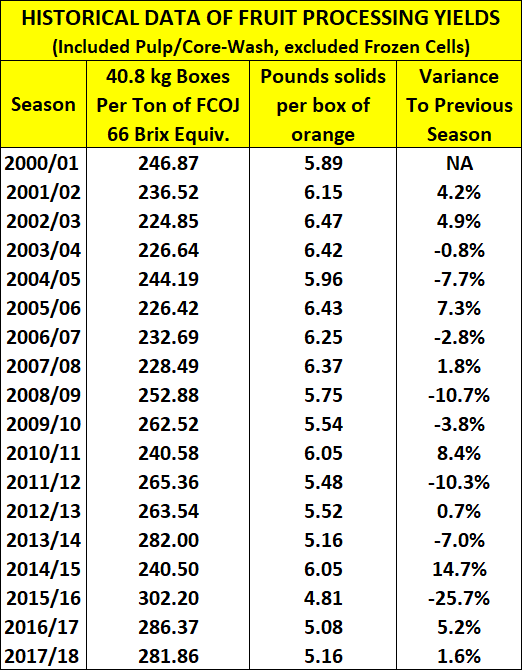

Based on an individual and confidential data compilation carried out by an independent auditing firm, the Brazilian Association of Citrus Exporters (CitrusBR) informs that its members processed in the 2017/2018 season the total amount of 339,997,000 orange boxes of 40.8 kg, an 83.2% increase over the 185,569,000 boxes processed in the previous season. The average yield on fruit in the 2017/2018 season was 281.86 boxes of oranges of 40.8 kg required to produce one metric ton of FCOJ 66 Brix equivalent, 1.6% better than the 286.3 boxes per ton required in the previous season. In the 2017/2018 season, CitrusBR members produced 1,206,252 tons of FCOJ equivalent, an 86.1% increase over the 648,004 tons produced in the 2016/17 season.

For all São Paulo-based non-members of CitrusBR, we estimate a total processing volume around 30,700,000 boxes of oranges of 40.8 kg in the 2017/2018 season, an increase of 88.3% over the 16,300,000 estimated in the previous period. The average yield on fruit estimated for these companies is around 296.7 boxes of oranges required for the production of one ton of FCOJ equivalent, an improvement of 2.1% when compared to the 303 boxes required to produce one ton of FCOJ equivalent in the previous season. Assuming these figures, CitrusBR estimates a total juice production around 103,472 tons of FCOJ equivalent for non-CitrusBR members, a 91.8% increase when compared to the 53,935 tons produced in the previous season.

Considering these assumptions, it is possible to estimate a total processing volume around 370,697,000 boxes of oranges of 40.8 kgs by CitrusBR and non-CitrusBR members in the 2017/2018 season, an 83.6% increase over the 201,869,000 boxes processed in the 2016/2017 season. Total juice production in the 2017/2018 season, also considering São Paulo-based companies who are members and non-members of CitrusBR is therefore estimated at 1,309,724 tons, an increase of 86.6% over the 701,939 tons estimated in the previous season.

SUPPLY AND DEMAND / NEXT SEASON

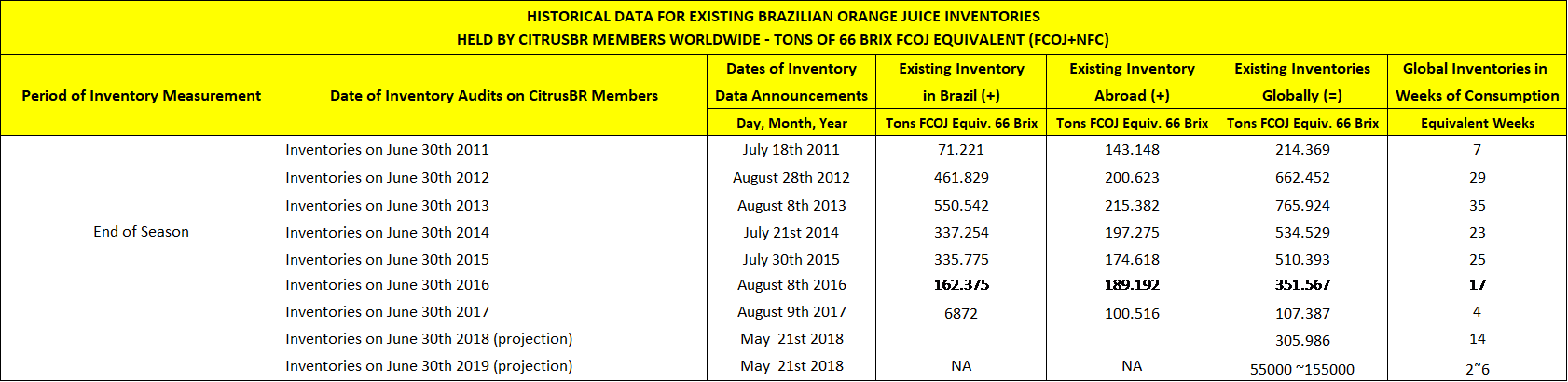

Based on an individual and confidential data compilation carried out by an independent auditing firm, the Brazilian Association of Citrus Exporters (CitrusBR) reestimates the worldwide inventories of Brazilian orange juice for June 30th 2018 to be 305,986 tons of FCOJ equivalent 66 brix. The forecast represents a 20.3% increase when compared to the projection from february 2018, when the forecast was at 254,200 tons for the same period.

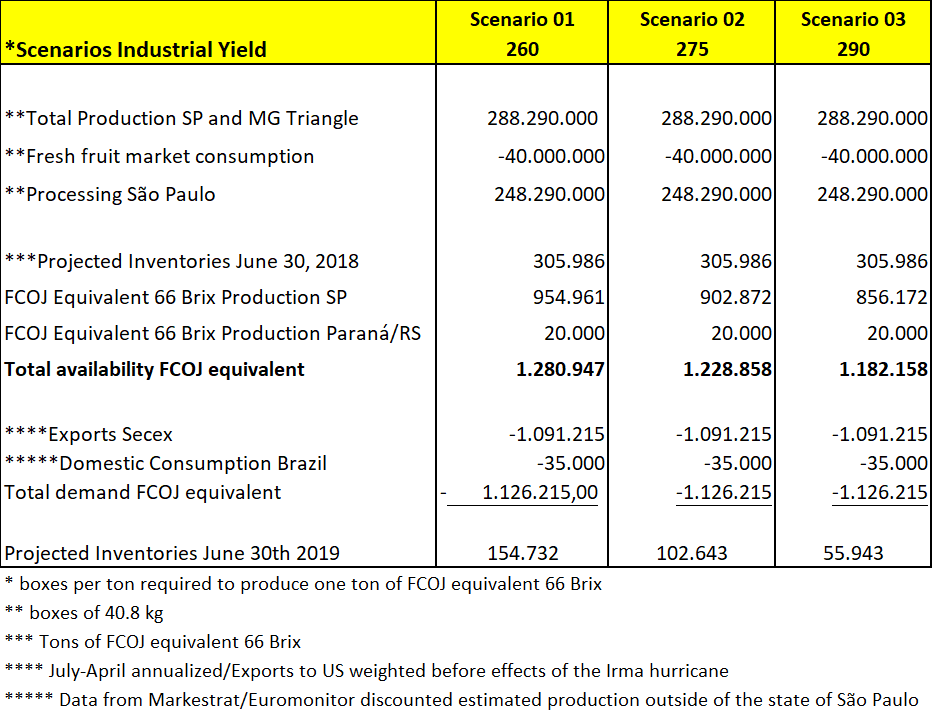

With a fruit production estimated by Fundecitrus at 288,390,000 boxes of 40.8 Kg in the 2018/2019 season, considering a fresh fruit Market around 40,000,000 boxes it is reasonable to estimate a fruit availability for processing around 243,390,000 boxes for São Paulo-based companies who are members and non-members of CitrusBR.

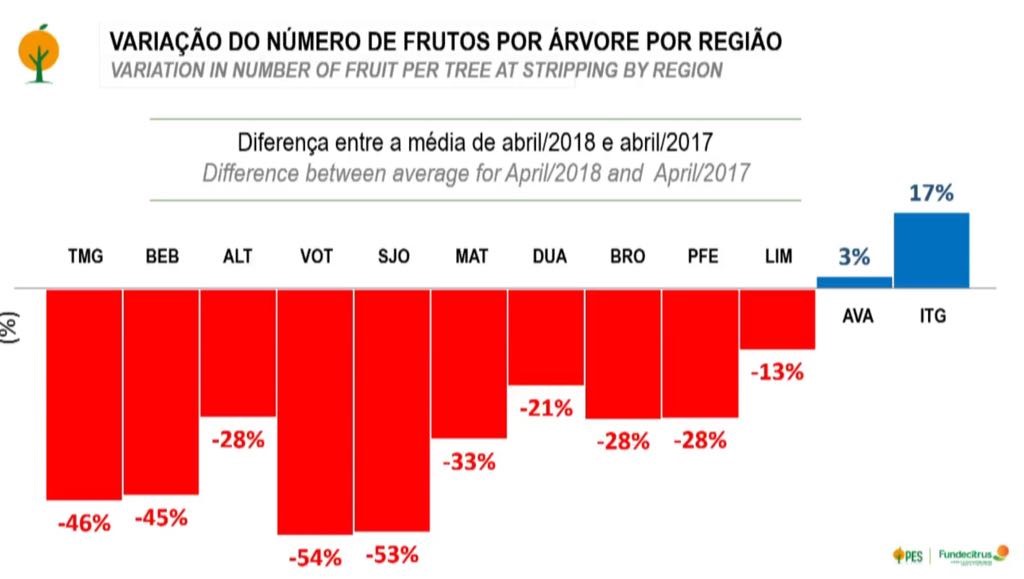

Although the dry weather of the last 70 days favours an improvement in the industrial yield on fruit, data presented by Fundecitrus on May 9th showed that the regions of the Minas Gerais Triangle, Bebedouro, Votuporanga and São José do Rio Preto present crop decreases between 45 and 54% when compared to the previous season, influecing the average total yield on fruit due to the fruit mix from different regions, with a higher proportion of varieties produced in the southwest of the state, with lower industrial yield in comparison to the fruit produced in the regions affected by the dry weather.

In order to better inform the Market, and considering variables such as the total fruit supply for processing, total exports volume , domestic market consumption and industrial yield on fruit, CitrusBR believes inventories of orange juices projected for June 30, 2019 may vary within an interval from 56,000 to 155,000 tons, following the assumptions above and according to the table below:

São Paulo, 22 de maio de 2018

Ibiapaba Netto

Diretor Executivo

_________________

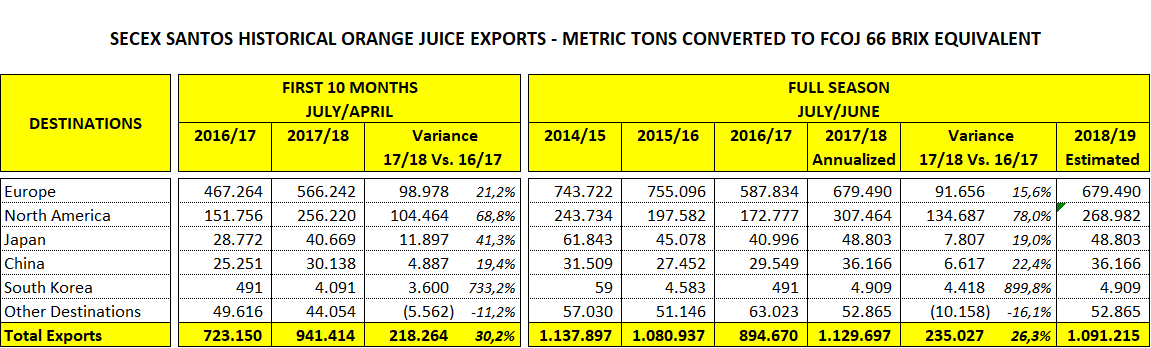

[1] Brazilian exports registered by Secex, leaving via port of Santos in the last 10 months annualized for the period of 12 months. Since it is not known whether the effects of the Irma hurricane will keep affecting the Florida production and the Brazilian exports to the US, we have only considered the brazilian exports to the United Stated in the first five months of the year to avoid distortions;

[2] Consumption in the Brazilian domestic Market as reported in the Markestrat report based on Euromonitor and Tetrapak data, not considering production estimated in markets outside of the state of São Paulo;

Table 01: Historical data for existing Brazilian Orange Juice inventories held by CitrusBR Members worldwide – tons of 66 brix FCOJ

Table 02: Historical data of fruit processing yields obtained by CitrusBR’s members for production of Orange Juice

Table 03: *Secex historical orange Juice Exports – metric tons coverted into FCOJ 66 brix equivalent

*July-April annualized/Exports to US weighted before effects of the Irma hurricane

Graphic 01: Variation in number of fruits per tree at stripping by region