Information to the Market

Click here to download the statement

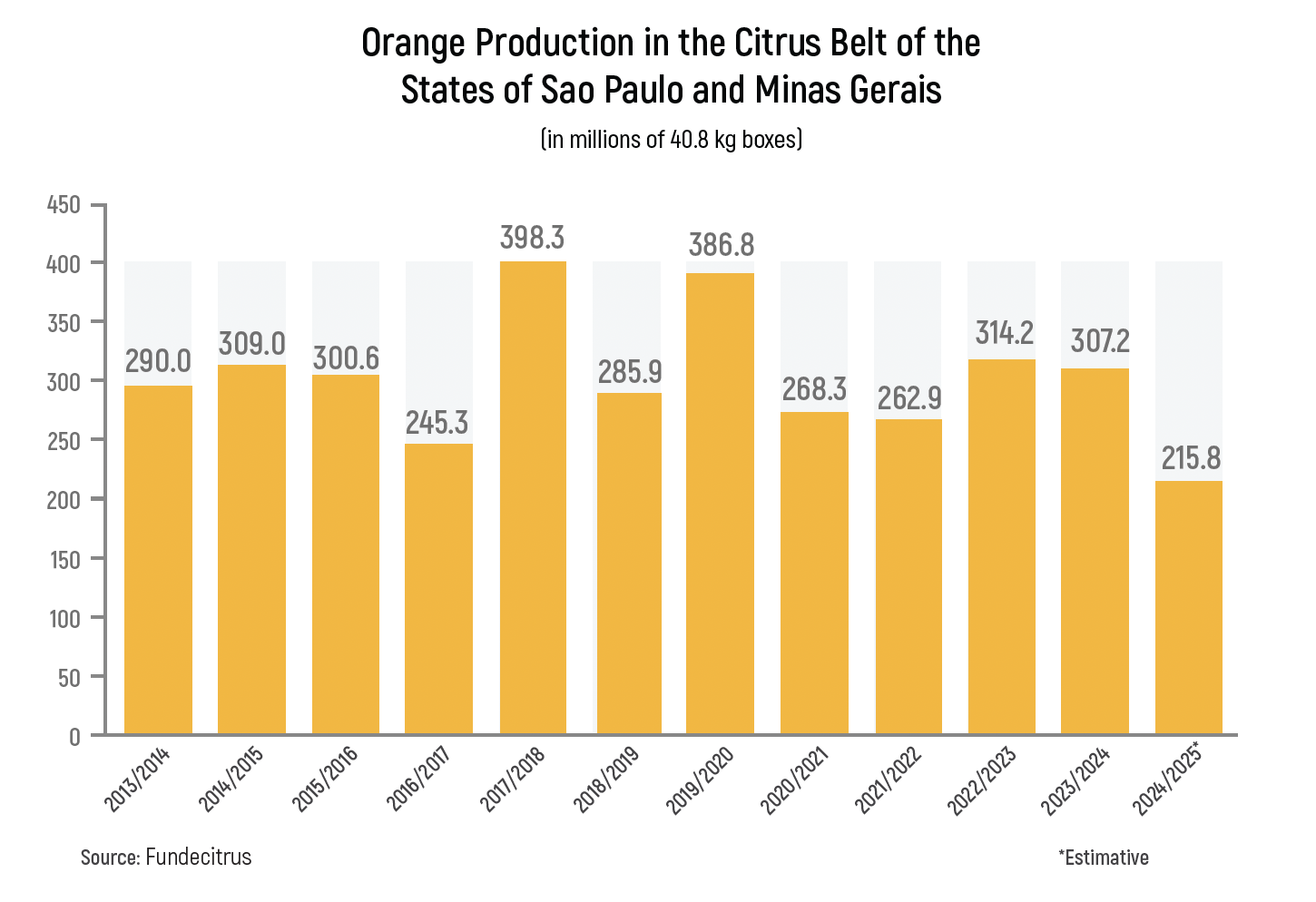

ORANGE PRODUCTION IN THE CITRUS BELT OF THE STATES OF SAO PAULO AND MINAS GERAIS

The Sao Paulo and Minas Gerais Citrus Belt has been going through five expressively low cycles in a row. With a production of 268.3 million boxes of oranges in the 2020/21 season, 262.9 million in the 2021/22 season, 314.2 million in the 2022/23 season, and 307.2 million in the 2023/24 season and an estimate of 215.8 million boxes for 2024/25 season.

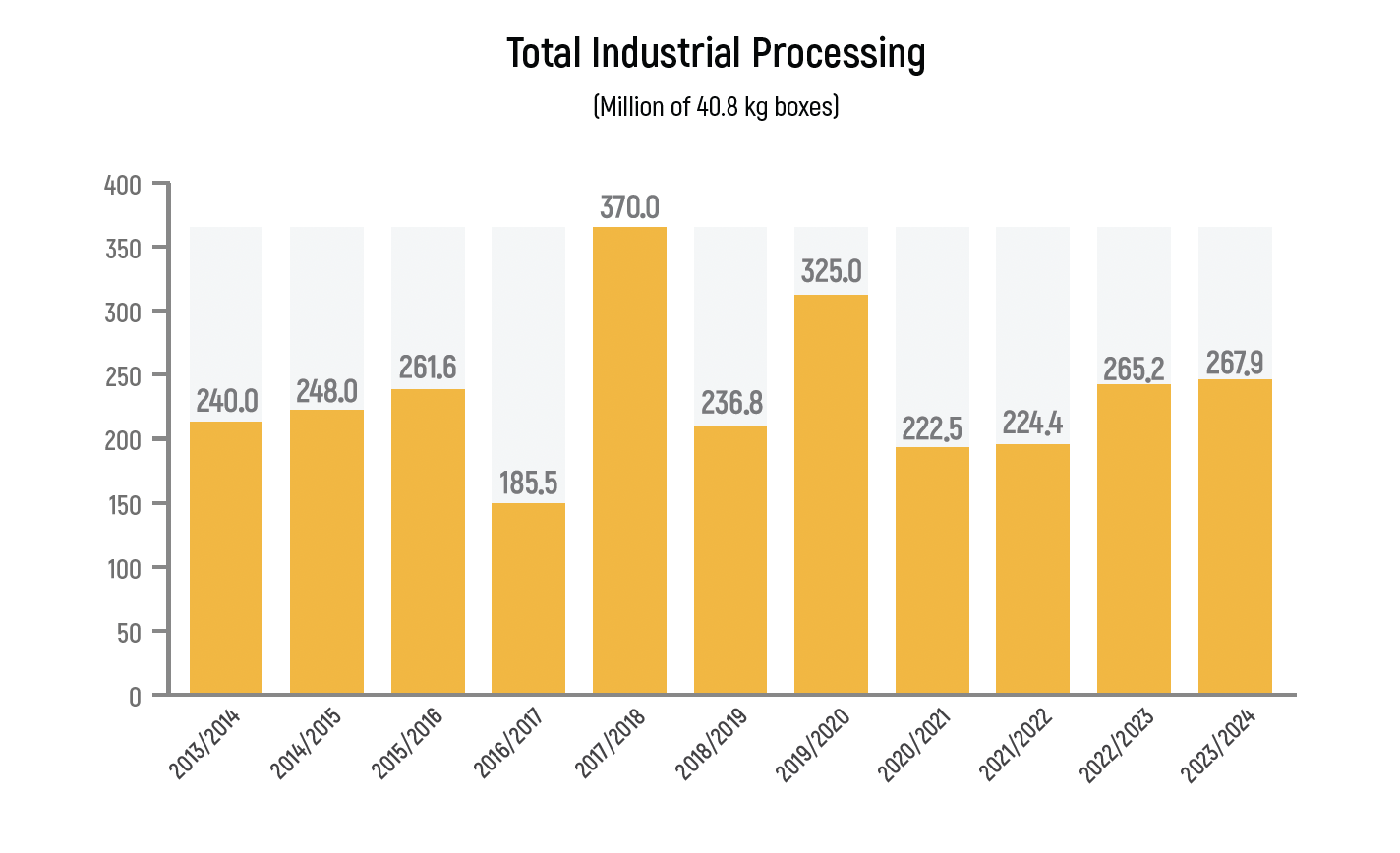

ORANGE PROCESSING AND ORANGE JUICE PRODUCTION IN THE 2023/24 SEASON:

A survey carried out through independent auditing of each of the companies associated with CitrusBR and also consolidated by external auditing revealed that the total oranges processed in the Sao Paulo and Minas Gerais Citrus Belt in the 2023/24 season was estimated at 267,937,531 boxes of oranges of 40.8 kg of which 243,270,864 boxes were processed by CitrusBR members and close to 24,6 million boxes were processed by non-members. The total fruit processed by the industry represented a drop of less than 1% as compared to the total processing of 265.292.217 boxes in the previous season.

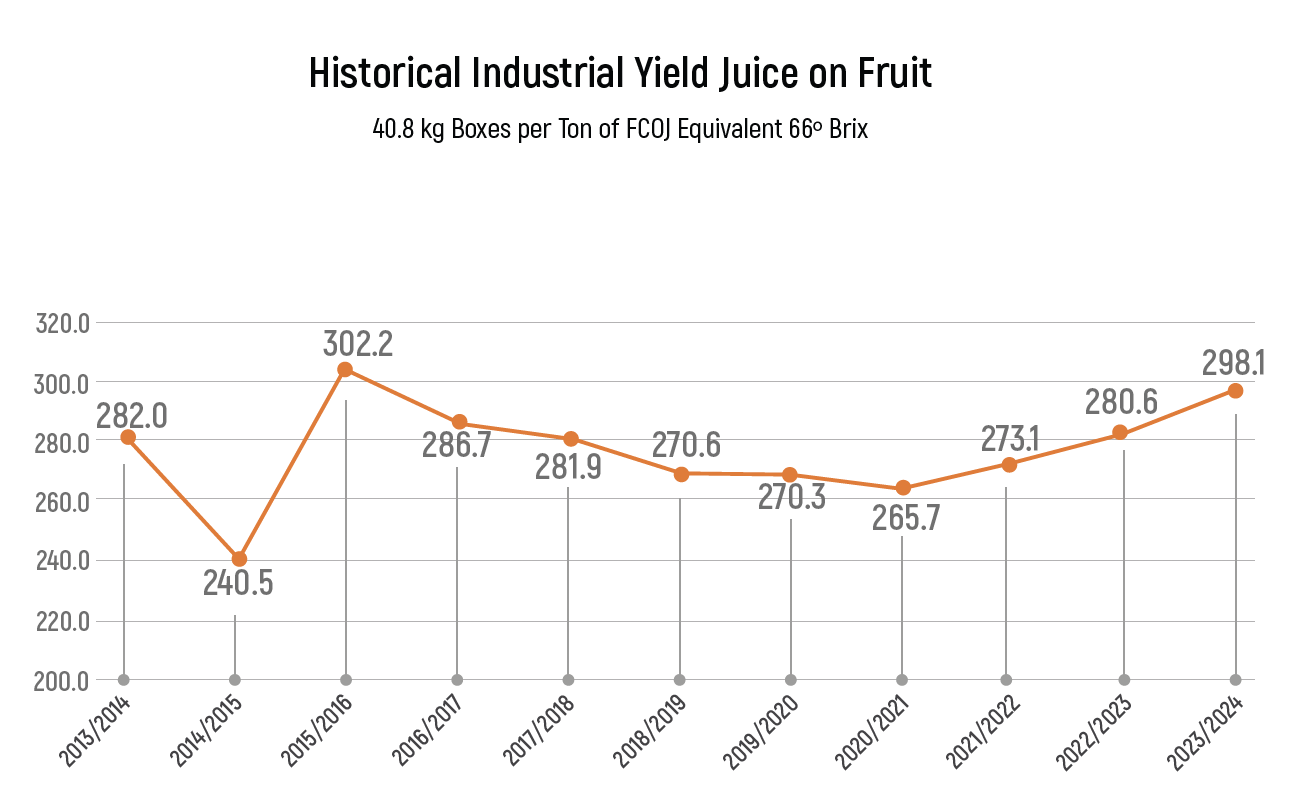

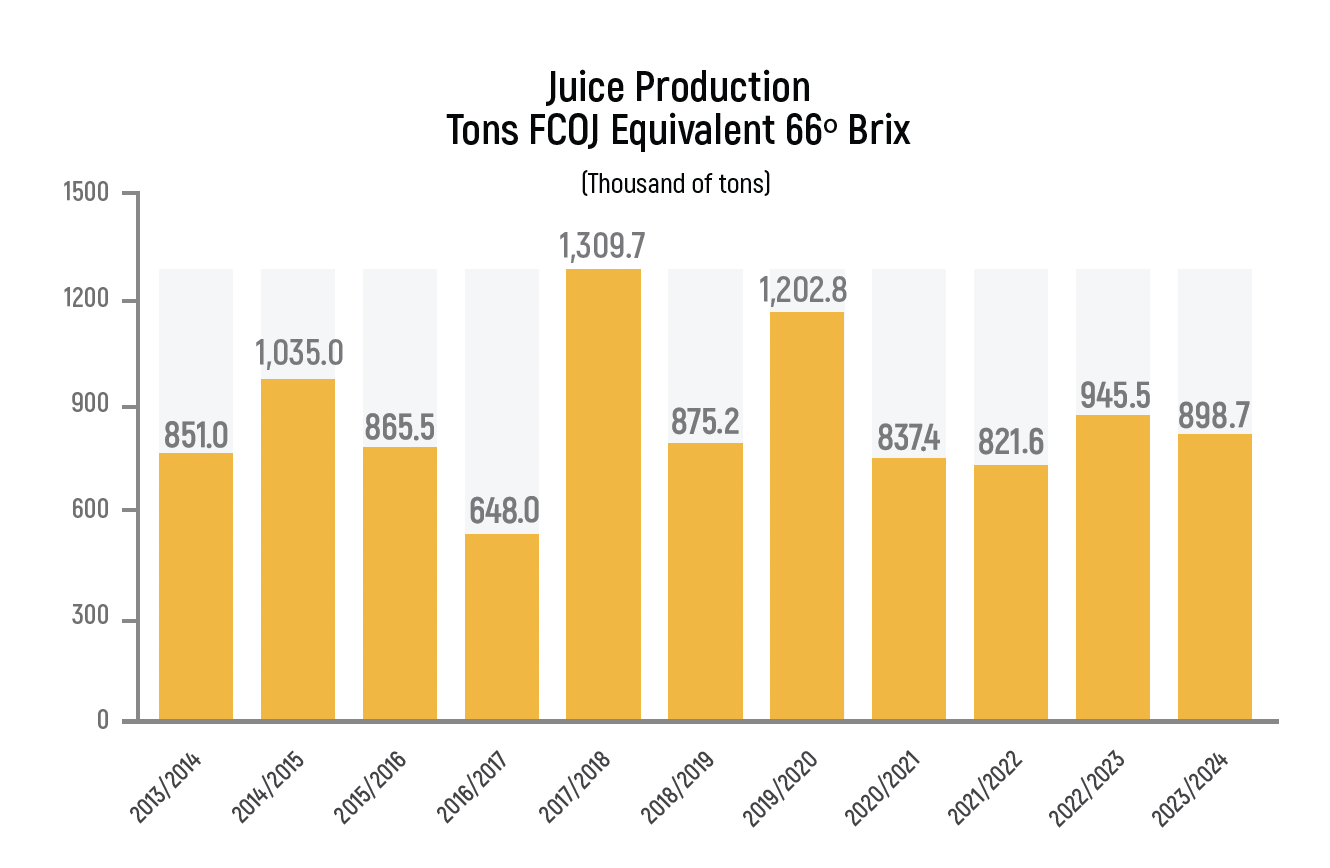

With the final estimated Juice Yield on Fruit of 298.2 boxes of 40.8 kg oranges to produce one metric ton of FCOJ Equivalent in aggregate for CitrusBR members and non-members, the final estimate for total orange juice production for the 2023/24 season was of 898.7 thousand metric tons of FCOJ Equivalent. It is important to note a decrease of 6,26% in the Juice Yield on Fruit, needing an additional 17.6 boxes to produce 1 ton of FCOJ Equivalent compared to 280.6 boxes in the previous season; second worse Juice Yield on fruit in history, contributed to a reduction of 56.3 thousand tons, compared to the previous season.

DEVELOPMENT OF THE QUALITATIVE ASPECTS FOR THE 2024/25 CROP

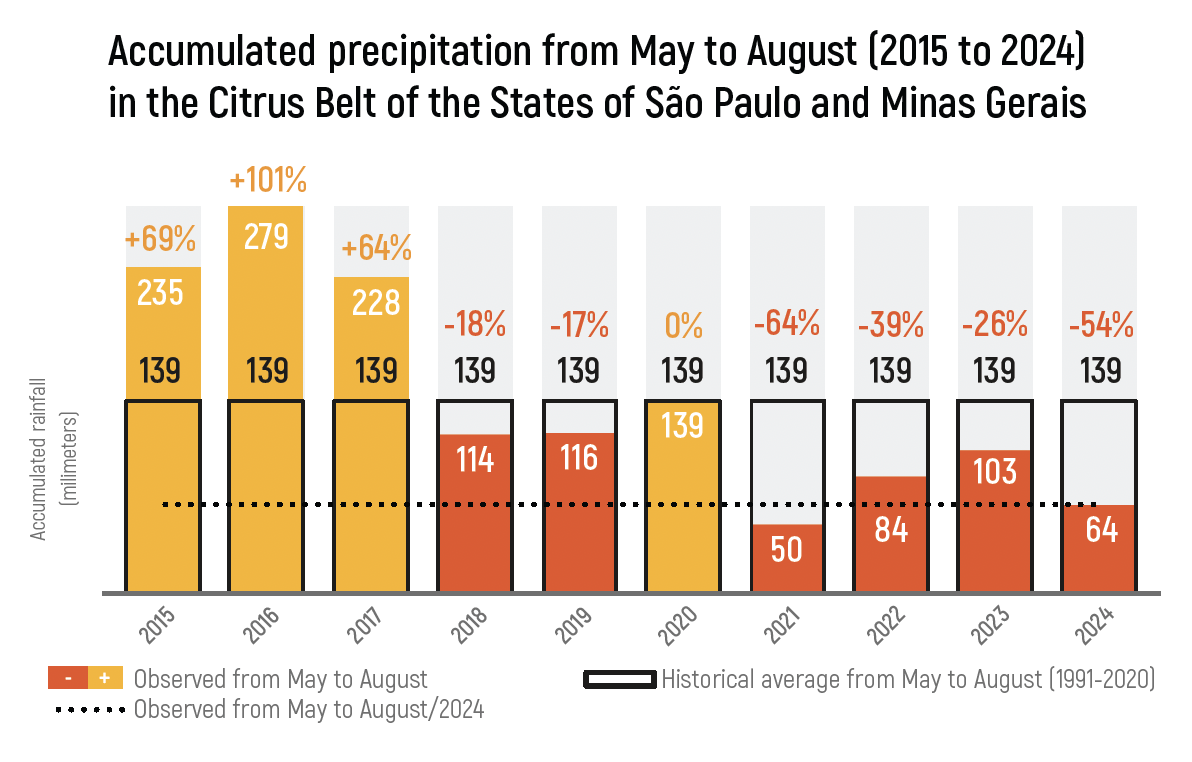

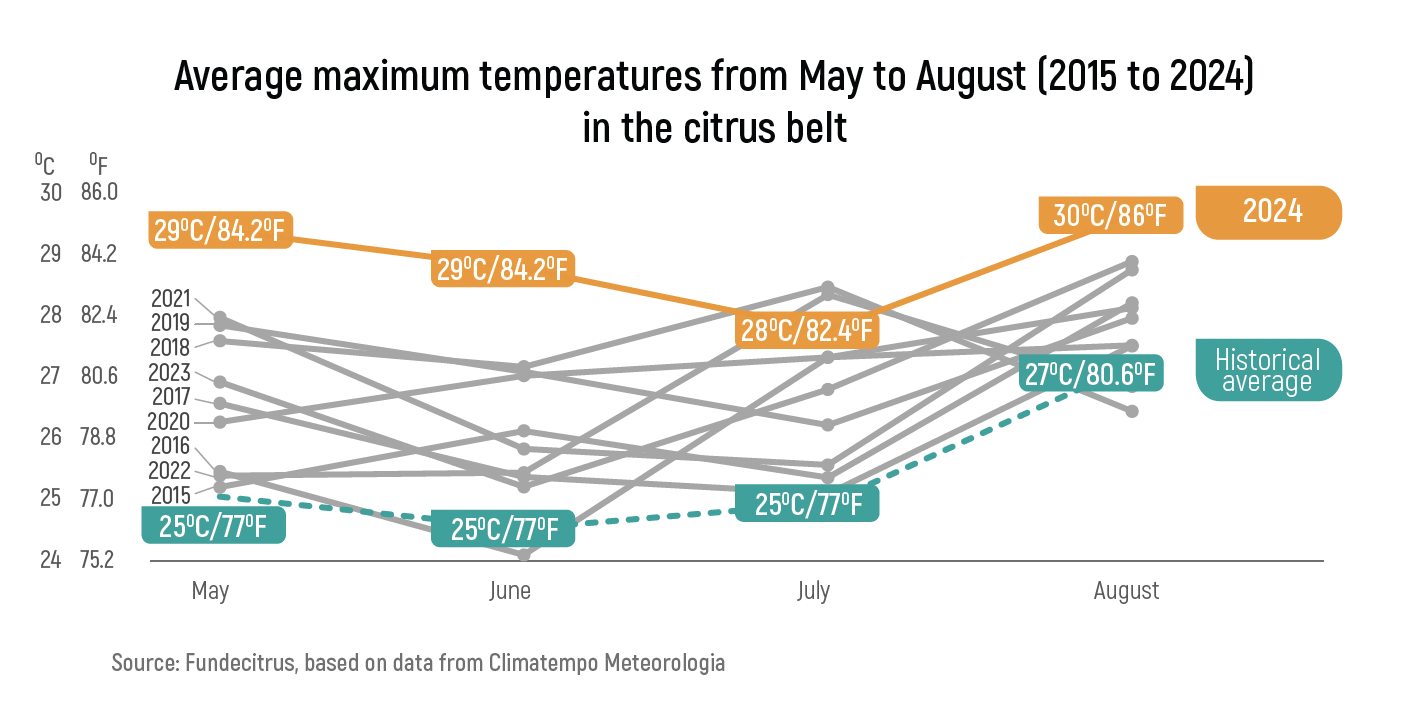

According to Fundecitrus information, the current 2024/25 season initially forecasted to harvest 232.0 million boxes has been affected by climate issues, thus reduced by 7% to 215.8 million boxes. The primary driver is the smaller fruit size due to adverse weather conditions, including higher-than-normal temperatures and below-expected rainfall which have been 31% lower than forecasted in the initial months of the harvest.

Moreover, both autumn and winter saw above-average temperatures, which heightened evapotranspiration and exacerbated drought conditions. The warmer weather accelerated the harvesting of the oranges, leading to a faster pace. By August, approximately 45% of the crop had already been harvested, significantly above the historical average for this period, which stands at 30%.

Despite such significantly accelerated harvesting and processing pace contribution to mitigation of increasing fruit droppage that further aggravates juice supply conditions, in the other hand negatively impacts some of the juice characteristics such as higher acidity (lower ratio), lighter and paler colour, and more evident bitter notes (higher limonin levels).

If the unfavourable climate conditions persist, given the actual historical low levels of inventory of orange juice, CitrusBR members force that despite of all efforts to ensure high quality supplies to their customers, the blending and homogenization capacity will be reduced affecting the quality standards in the coming months.

AUDITED INVENTORIES ON JUNE 30TH, 2024:

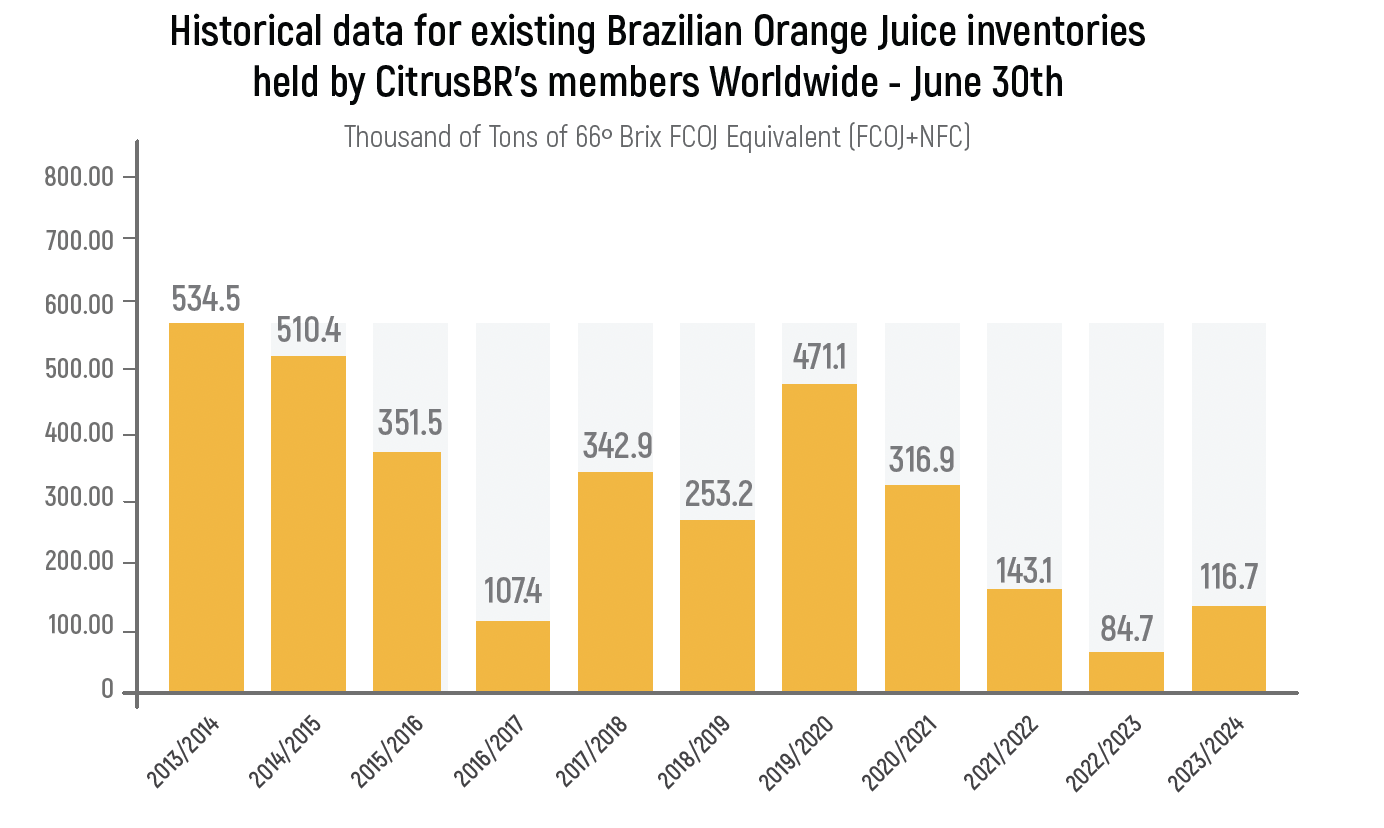

The same survey revealed that the Global Inventories of Brazilian Orange Juice, converted into Frozen Concentrated Orange Juice Equivalent to 66° Brix (FCOJ Equivalent), held by its associates on June 30th, 2024, amounted to 116,710 metric tons, a recovery of 37.7% compared to the 84,745 tons recorded in the same period of the previous year, but the 3rd lowest number in historical data.

Despite a slight recovery of 31.9 tons compared to the previous season, the current inventory level still challenges the supply and blending capacity, especially since the sector is experiencing the smallest harvest in 30 years, putting additional pressure in fruit and juice availability to the international market.

Graph 7 presents historical data for existing Brazilian Orange Juice Inventories held by CitrusBR’s members worldwide on June 30th of every season.

INVENTORY PROJECTIONS FOR JUNE 30TH, 2025:

When observing the 2024/25 harvest with a 29.7% lower production compared to the previous season in the citrus belt of São Paulo and Minas Gerais, combined with challenges related to Brix levels, it is possible to foresee disruptions in supply throughout the season. Therefore, at this moment, it is challenging to assess supply and demand conditions in the coming months and, consequently, to predict orange juice inventory levels as of June 30th , 2025.

Sao Paulo, September, 19th 2024

Ibiapaba Netto

Executive-Director